|

|

|

Hi folks, we hope the week has been treating you well. We’re back with another media update for your review – let’s dive in!

Key Highlights (simply click the section you'd like to jump to):

|

1. TV & Audio: Amazon has gone deeper into the streaming sports ecosystem, reportedly securing a deal with the NBA to broadcast regular-season and playoff games on Prime Video.

|

2. Paid Social: TikTok’s clock to sell or be banned has officially begun, and Meta rolls out its most powerful LLM to date, Llama 3.

|

3. Display & Programmatic: Google’s NewFront unveils new features and enhanced buying processes, accessing premium streaming inventory from Disney, NBCUniversal, Paramount, and Warner Bros. Discovery.

|

4. Ad Economy: A stalemate in Europe - Google’s plan to sunset 3P cookies put on ice.

|

5. Consumer Economy: Overall economic growth slowed in Q1, with inflation remaining stubbornly elevated and consumer sentiment waning.

|

|

|

|

|

|

1. If you’ve been underwhelmed by the first round of the NBA playoffs (as Pelicans fans like myself may have been), you may find more excitement behind the scenes. Despite decades-long relationships (and billions of dollars of revenue), the NBA has let lapse an exclusive media rights negotiating window with Disney and Warner Bros Discovery, freeing the league to explore partnerships with other broadcasters. Apple, YouTube, NBCUniversal, Peacock, and Netflix have all reportedly expressed interest in deals with the NBA, but already Amazon Prime has jumped to the front of the pack, reportedly securing a ten-year deal with the NBA to broadcast regular-season and playoff games on Prime Video. Disney and ESPN are expected to maintain a package of games (potentially including the NBA Finals), meaning Warner Bros will have to fight with the newcomers for what remains.

|

|

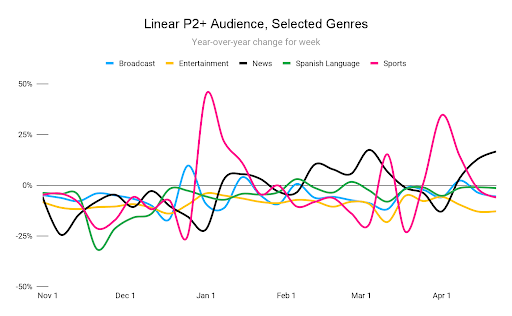

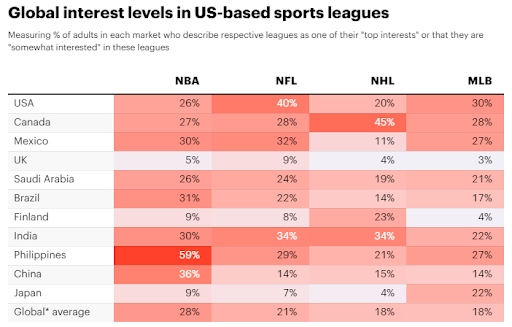

Amazon’s deal represents a sea change in the streaming sports landscape. The NBA boasts a massive viewership pool, both in the US and internationally. With Thursday Night Football already in its quiver, Prime Video holds major broadcast rights to two of the largest leagues in domestic sports, bolstering its prestige among viewers and advertisers, while further turning the screws on legacy linear. With sports streamers seeing big gains in viewership and major publishers putting their offerings front-and-center, it is clear that the streaming train is not slowing down, and the opportunity for advertisers of all complexions is growing. Between the sheer audience size, diversity of content, and measurement and targeting tools available, digital video continues to expand its capabilities as a channel across the full funnel. | CNBC, YouGov

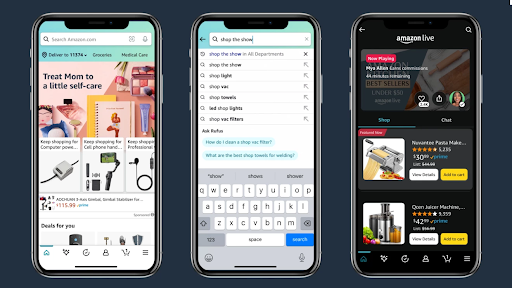

2. Blurred lines – it’s not just a Robin Thicke song at the center of a lawsuit, it’s also a mantra for the decreasing distinction between traditional advertising channels. Case in point – Amazon Live has launched a new shoppable, free ad-supported TV (FAST) network to Prime Video and Freevee. The new channel integrates directly with the Amazon app, allowing customers to “shop the show” and buy items featured on screen in real time.

|

|

Shoppable streaming is becoming more popular, with major players like Disney getting in the game, and the appeal to advertisers is clear given the high percentage of TV viewers using their phones while watching. Strategically, this content shows the growing obsolescence of a siloed approach to advertising; the case for distinct campaign elements – TV vs. Social vs. Search vs. Commerce – or distinct strategies – Awareness vs. Consideration vs. Conversion – is weakening. As advertising mediums become more blended, advertisers can use all of these channels together to achieve their goals – the heart of a true full-funnel, integrated campaign. | AdAge, Amazon, MarketingDive

3. We discussed Walmart’s acquisition of Vizio in our April 5th newsletter, specifically focusing on the lucrative ACR data Walmart would get access to and – critically – could withhold from other users. We flagged that other smart TV providers could pick up the slack, and that prediction has come to pass – Roku and iSpot announced a partnership this week to share cross-platform audience and measurement data with each other.

|

|

The size and speed of this deal between two large players in the streaming and measurement spaces shows both how important ACR data is becoming to the landscape and how much of a threat the Walmart-Vizio deal represents to those reliant on it. ACR has its limits as a measurement tool – it is heavily sampled data which can lead to measurement bias, and it sits in a gray area with respect to user privacy. That said, it is experiencing impressive tailwinds, and we should expect more measurement providers to explore it, especially to gauge audience metrics like linear-to-streaming overlap. | AdAge, BusinessWire

– Harry Browne

|

|

|

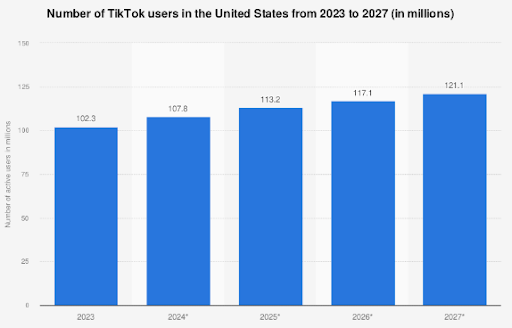

1. As many of you may recall, the House passed a standalone bill in March that was awaiting a vote from the Senate. On April 24th, President Biden signed a bill approving foreign aid for Ukraine, Israel, and Taiwan. Within that bill was a law stipulating that ByteDance must sell their stake in TikTok within 12 months, or the app will be banned in the United States. TikTok will have until January 19, 2025 to divest any Chinese interests, but the US President can invoke a 90 day extension. TikTok already came out expressing that they will fight in the courts which will further extend the January 19th deadline. ByteDance came out shortly after the law passed, to squash any rumors that they were internally considering a sale, and instead they plan to challenge the law.

|

|

Prior to the bill being signed, TikTok usership was expected to continue to steadily rise into 2027. For advertisers and users alike, there is still a long road ahead before any changes take place. Tinuiti is advising our clients to maintain a business-as-usual approach through the end of 2024. When looking at 2025, it is too soon to know what the outlook will be, but it is expected that continued legal challenges will delay any bans or sales, well into 2025. For any advertisers already thinking about 2025, Tinuiti recommends that 1H 2025 be planned in a business-as-usual fashion as well. Additional updates on the evolving situation will be included in these updates in the future. | The Wall Street Journal, Statistica, NPR

2. On April 18th, Meta launched the highly anticipated Llama 3 large language model (LLM). Llama 3 is Meta’s version of ChatGPT. LLMs are crucial infrastructure for AI, acting as the foundation for AI assistants and products. Llama 3 is open source, meaning that anyone can download it, use it, and even build off of it. Meta’s press release specifically called out availability on some of the biggest industry names including AWS Databricks, Google Cloud, NVIDIA, Snowflake, Microsoft Azure, and many more.

Overnight, Meta’s Llama 3 became incredibly competitive with the likes of OpenAI and Google of its accessibility and its lower cost of operation. Unlike OpenAI’s GPT and Google’s Gemini, Llama 3’s advanced features are free and open source, allowing anyone to use it with no guardrails on commercial or personal use.

|

|

Llama 3’s accessibility will be a big win for advertisers. The model was trained on over 15 trillion tokens, a significant increase from the 2 trillion tokens in Llama 2 and a marginal advantage over GPT-4’s 13 trillion, and those tokens predominantly derived from within Meta’s ecosystem. This means that Llama 3’s second language is emoji. The opportunities for advertisers are almost limitless, especially when it comes to ingesting and generating social media content. Turnkey opportunities include the ability to quickly generate copy revisions; and even generate new creative, making creative and copy testing significantly easier than ever before. Furthermore, Llama 3’s open source nature means that advertisers can use the generated content and AI pipelines on any platform.

AI solutions were central to Meta’s Q1 earnings call, but Wall Street did not respond favorably, due to the significant capital investment involved. Meta plans to continue to invest in this infrastructure as it will influence their algorithms, which is critical for advertising inventory and user engagement on the platform. Over the coming months, as more data providers and agencies, including Tinuiti, lean into the new Llama 3 LLM, added media and workflow efficiencies are expected. | Meta, Meta, Wired, Zapier

– Jack Johnston

|

|

|

1. On the heels of an earnings call that exceeded expectations, Google kicked off IAB NewFronts this week to discuss the era of CTV. If you (like me) were expecting YouTube to be in the spotlight, you would only be partially right. Unlike the earnings call where YouTube was the star, Google’s DSP, Display & Video 360 (DV360), took center stage, highlighting deepening partnerships with streaming partners and new AI optimization features.

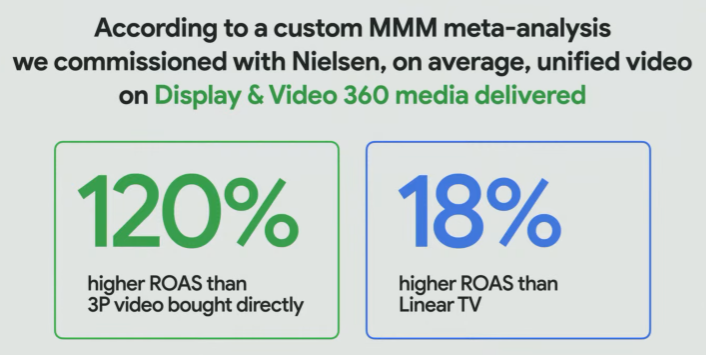

DV360’s reach is expansive, extending to 92% of all ad-supported CTV viewing households. With strengthening relationships across partners such as Disney, Warner Bros. Discovery, and Paramount, advertisers now have the ability to plan and execute their streaming and YouTube investments all from within DV360. Google also announced a few new features with the aim to improve the optimization process, the first of which is the expansion of instant deals. Historically available only for buying premium YouTube content, advertisers will now also be able to access premium streaming inventory for their campaigns from partners like Disney. And with the release of DV360’s new commitment optimizer, Google claims its AI will provide an optimized media mix recommendation across deal types, allowing for greater flexibility and reach. To highlight the benefits, Google showcased a few case studies, touting that marketers who have unified their media buying within DV360 have seen a 120% higher return on ad spend compared to third-party video bought directly.

|

|

As the definition of TV viewership evolves to include everything from short-form and long-form creator content to highly produced Hollywood scripted content, advertisers will need to think more of a holistic video strategy as opposed to viewing different content in silos. Advanced advertisers will lean in to understand what their audience is consuming and consolidate their approach to efficiently reach them across platforms. While the streamlined approach within DV360 may simplify some of the buying for advertisers, direct partnerships with publishers may still be advantageous. To determine the efficacy of the overall video program, advertisers should continue to lean into a thorough testing and measurement framework, inclusive of incrementality testing and media mix modeling (MMM) to ensure plans are driving business outcomes. | Google Blog, YouTube

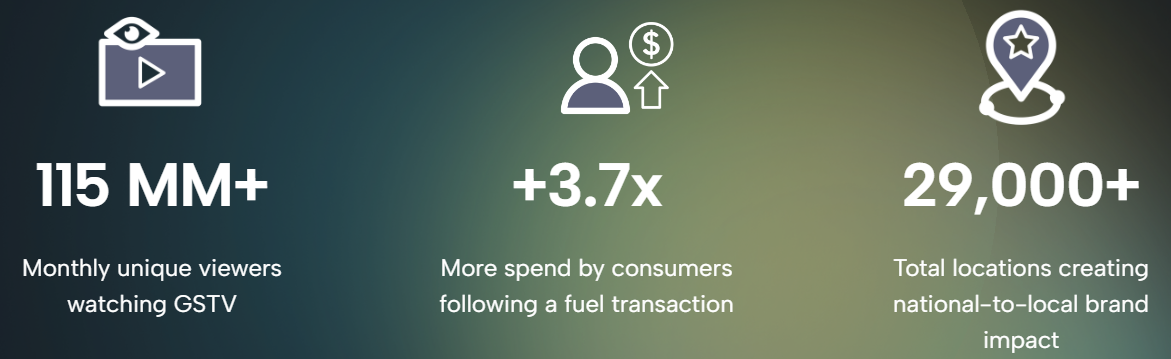

2. Last month, we talked to you about the promising future of digital out-of-home (DOOH) and the rollout of additional programmatic inventory sources. This month, we have continued to see DOOH evolve particularly around measurement with the Gas Station TV (GSTV) and Samba TV partnership. |

|

Through the partnership, GSTV, which operates in over 29K locations and reaches 115M monthly unique viewers across the U.S., may now be able to measure deduplicated reach across linear television and non-traditional national video within a holistic-video campaign. While GSTV did not provide specific details into some of the early tests with Samba TV, they claim recent studies have yielded double-digit incremental reach to national linear campaigns and delivered over 5x the impression share of light TV viewers.

This latest announcement adds to GSTV’s focus on reaching a unique and engaged audience. In 2022, a GSTV-sponsored study by Affinity Solutions highlighted that within three hours after fueling, consumers spend 3.7 times more money and transact 4.2 times more frequently compared to those not fueling that day.

|

|

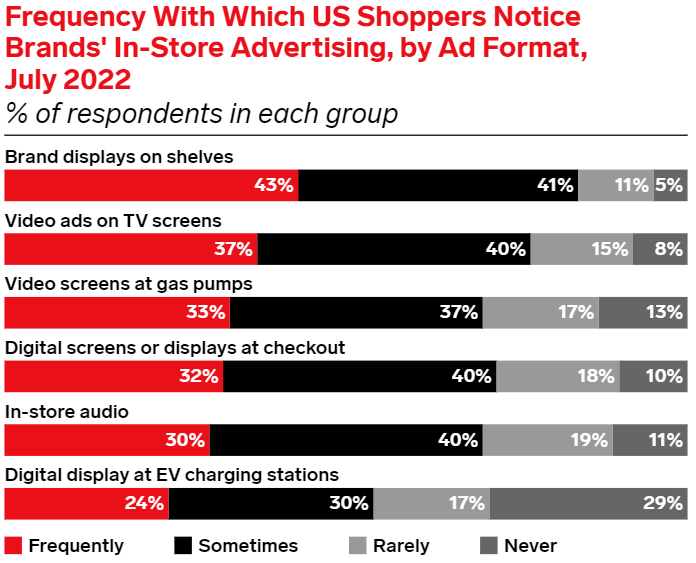

GSTV's study and an eMarketer survey show gas station video screens are being noticed by an engaged audience. While performance measurement is still evolving, GSTV can still be an effective way to influence brand awareness and consideration through high-quality creative. | GSTV, PR Newswire, eMarketer

– Brian Binder

|

|

|

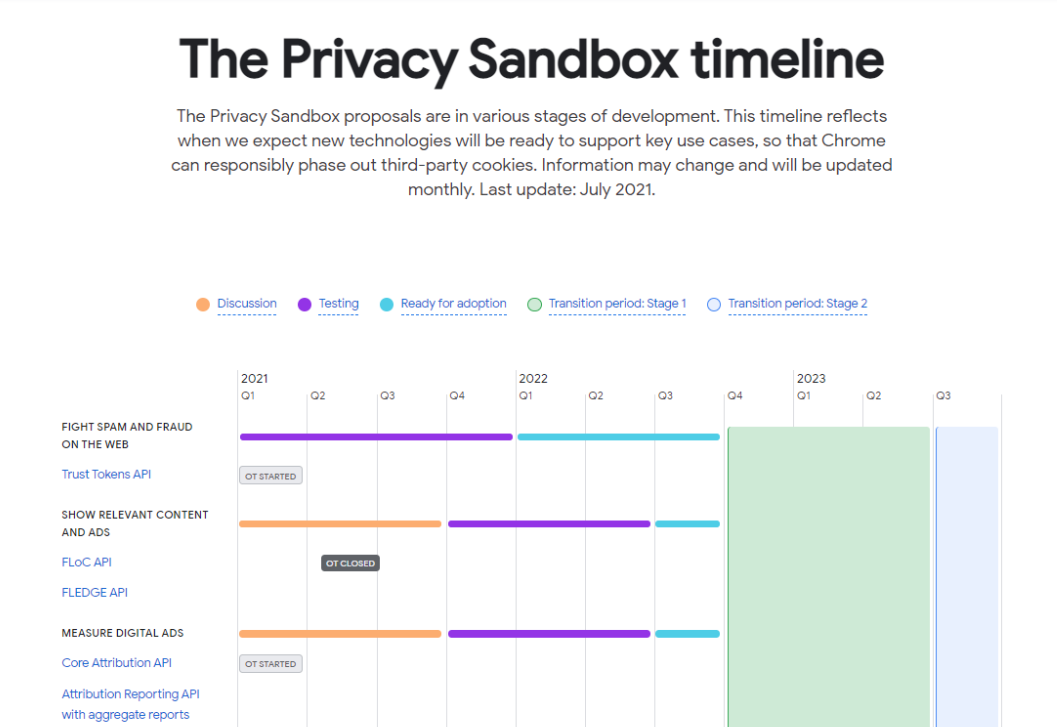

1. Were Benjamin Franklin alive today, he may well have been quoted as saying, “Nothing is certain except death, taxes and Google delaying 3P cookie deprecation (3PCD).” Despite Google announcing its intention to deprecate 3P cookies with its Chrome browser back in August of 2019, 3P cookies remain a vital component of the programmatic advertising ecosystem today. In what now seems to be an annual occurrence, Google has once again announced that the timeline towards 3PCD has been delayed until an unknown date in the future.

While the original announcement of Google’s 3PCD plan was met with heightened fervor from privacy hawks, advertisers, and publishers, we have since seen a cavalcade of delays and timeline deferrals. Despite an initial timeline targeting Q4 2022 for 3PCD and introduction of a set of privacy-preserving APIs collectively known as “The Privacy Sandbox,” the timeline has continued to shift further into the future.

|

|

The concept of 3PCD in favor of less intrusive user tracking is not exclusive to Google, and did not come as a surprise to industry insiders when it was originally announced. In fact, Google Chrome is the only major browser that still utilizes 3P cookies (a relic of the Clinton administration, having originally been created by Netscape in 1994); it is also the world’s most popular browser in terms of MAUs, and happens to be owned by the world's largest digital advertising company.

Given Google’s dominance in the digital world, it is not surprising that it has been targeted by privacy hawks and competition watch dogs alike. Every move that Google makes is overanalyzed, and they are incredibly aware of the risks associated with diminishing their advertising revenue (that, as of Q1 2024, still accounts for north of 75% of their total revenue) or opening the door to a potential challenger. In what can only be described as a battle between David & Goliath, the UK Competition & Markets Authority (UKCMA) has taken umbrage with the self-preferencing design of the Privacy Sandbox, noting that this replacement solution will essentially create a two-tier system (given Google’s ability to rely on their own 1P data for their advertising mechanisms, with others needing to rely on contextual cohorts by way of the Topics API) and only further enshrine Google’s dominance in digital advertising moving forward.

The concerns raised by the UKCMA in their Q1 2024 Privacy Sandbox report are not new and have been echoed for several years. As battles begin, they are often dynamic with the front lines continuing to move as territory is gained or lost. As the battle becomes a war, though, the front lines become entrenched, and the realities of the harsh winter where there is little movement from either side come into focus. In this theater, there may never be a victor unless there are significant changes to overcome the current stalemate.

It is clear that the fundamental design of the Privacy Sandbox APIs (with a particular focus on the Topics API & Related Website Sets API) are at odds with expectations of the UKCMA, and will either need to be reworked, or perhaps administered by an independent body. One thing is for sure though, the path towards the deprecation of 3P cookies within Chrome has never been more uncertain. | Google, UKCMA

– Simon Poulton

|

|

|

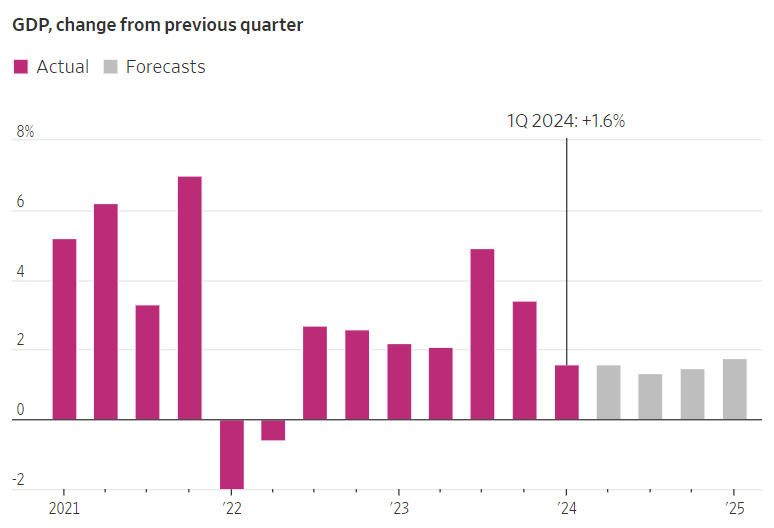

1. In recent months we’ve often reported a rosy macroeconomic picture, even quoting in March an observers’ view that we are seeing “the definition of a soft landing.” The most recent data points have gone a bit wobbly however, beginning with growth: the U.S. economy grew at a 1.6% seasonally- and inflation-adjusted annual rate in the first quarter, a significant deceleration from the second half of last year.

|

|

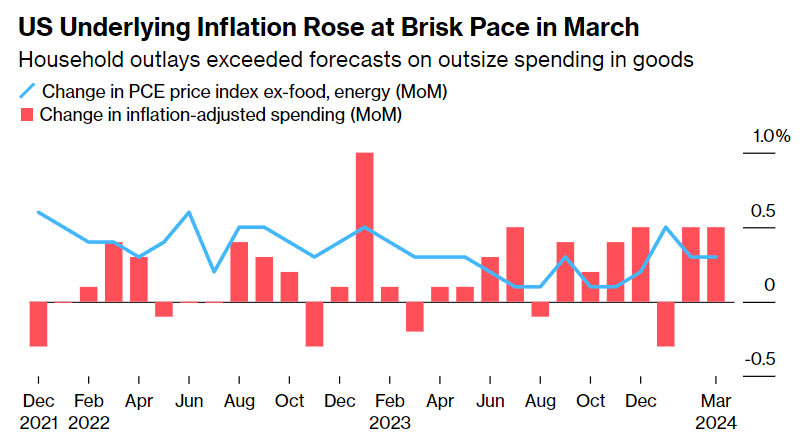

This presents a tricky situation for the Fed; normally, slower growth might be a cue for a lowering of interest rates. However, data for April show the Fed’s preferred inflation gauge well above target, making it highly unlikely that it will contemplate a rate cut anytime soon. The latest figure is a 0.3% MoM increase in the personal consumption expenditure index, and a 2.8% YoY increase. The latest figures are disappointing, as rates in the 0.1% - 0.2% MoM range late last year had some observers hoping the inflation problem had been put to bed.

|

|

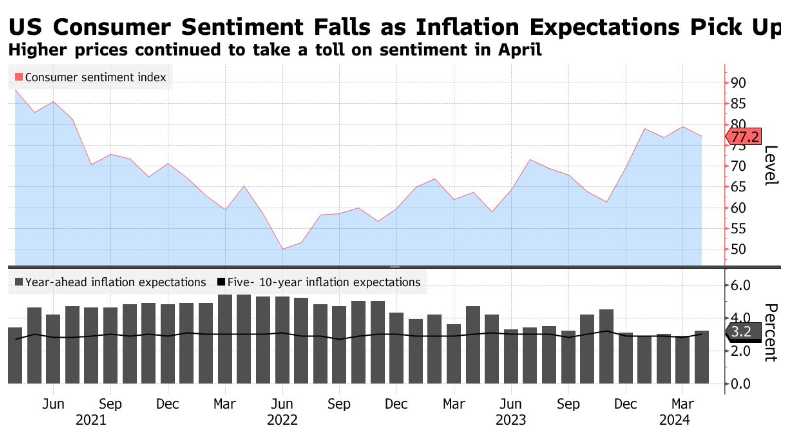

These developments have not been lost on consumers – consumer sentiment fell in April as consumers’ expectations of inflation rose. Sentiment remains considerably above where it was for all of 2022 and ‘23, and the April decrease may simply be noise in the signal.

|

|

None of these data points are too dramatic: the growth figures are similar to the first half of ‘23, the inflation figures haven’t increased from February, and consumer confidence dipped back to where it was in February. But collectively they defy a “we’re out of the woods” narrative. | WSJ, Bloomberg, Bloomberg

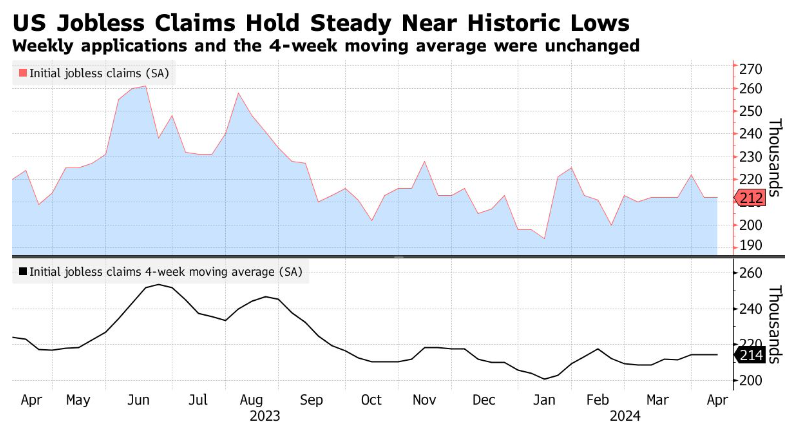

2. We told you last time about the labor market’s ongoing rude health, with robust March job creation tempered by the slowest rate of increase in hourly wages since June 2021. This latter data point is interpreted by most observers as a good thing, as it suggests that the labor market is not exerting upward pressure on the price level, which is the main macroeconomic concern at the moment. Fresh data from the Labor Department reinforce the picture of labor market strength, showing that initial claims for unemployment benefits remained subdued at 212k, while continuing claims held steady at 1.8m. |

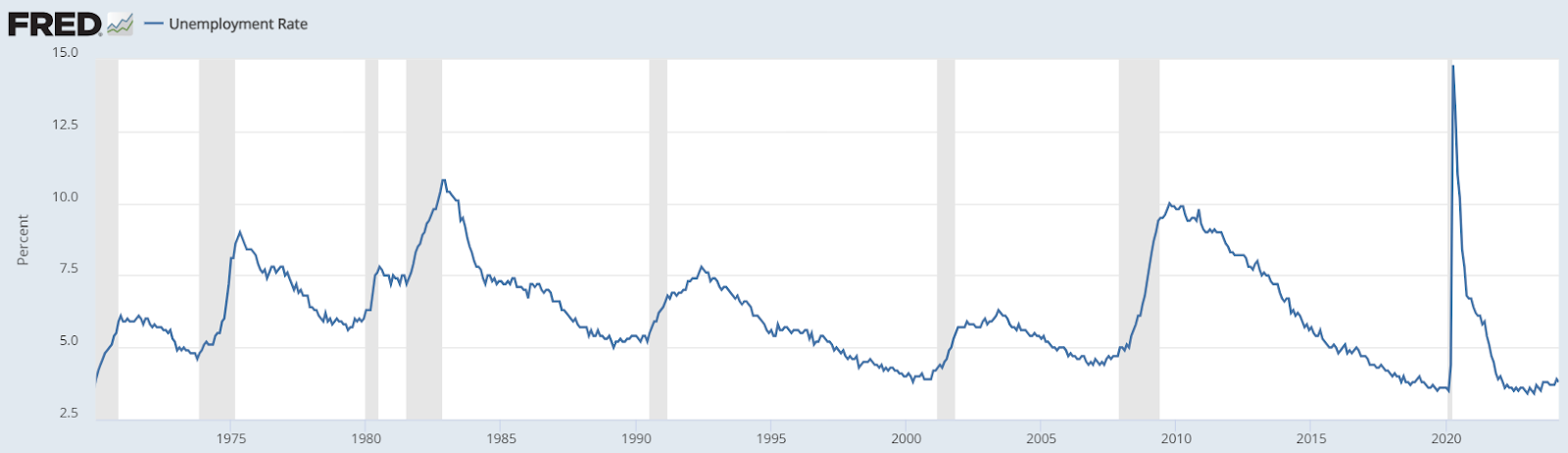

|

For some context, the average figures for the 20-year period preceding the pandemic were 345k initial applications and 2.9m continuing applications, putting the current figures approximately 40% below historical norms. This picture is consistent with historically low unemployment; the current 3.8% figure is extremely low by historical standards, indeed it was never that low in the entire three-decade period from 1970 to 2000. |

|

All of this suggests that the U.S. economy, whatever other problems it might have, is highly efficient in matching labor supply with demand. It also suggests that consumers will retain considerable spending power, even if it is underwritten by borrowing. | Bloomberg

– Sean Odlum |

That will do it for this week – as ever, if you have questions about how any of these items impact your own campaign please don’t hesitate to reach out to your Tinuiti team.

Simon Poulton, EVP Innovation & Growth

Harry Browne, VP Innovation & Growth

Brian Binder, Senior Director Innovation & Growth

Jack Johnston, Senior Director Innovation & Growth

Sean Odlum, CPO

|

|

|

|

|

|

|

|