|

|

|

Hi folks, we hope the week has been treating you well. We’re back with another media update for your review – let’s dive in!

Key Highlights (simply click the section you'd like to jump to):

|

1. TV & Audio: Podcast listenership continues its dramatic growth, fueled by gains across ages and demographics and further breaking down the barriers between traditional mediums.

|

2. Paid Social: Photo-sharing app BeReal gets acquired by Voodoo, a French company known for heavy advertising on YouTube and rapid mobile app growth.

|

3. Display & Programmatic: United Airlines is the latest company to develop its own media network, providing more opportunities for advertisers to connect with consumers in a highly targeted fashion.

|

4. Search (new!): Google’s AI Overviews are here, but it’s unclear what the impact is or will be for advertisers due to limited visibility into measurement.

|

5. Ad Economy: Oracle exits the advertising business.

|

6. Consumer Economy: April’s inflation was the lowest YTD, providing some grounds for macroeconomic optimism; and employers surpassed economists’ expectations by adding 272k jobs in May.

|

|

|

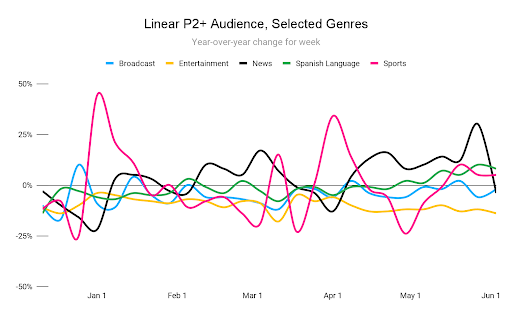

News and sports continue to show strong viewership figures, while entertainment programming remains suppressed. That trend is likely to continue over the summer, as news will benefit from the US presidential race (alongside major elections in the UK & France and ongoing Gaza ceasefire negotiations), sports will benefit from the Paris Olympics, and linear entertainment will face pressure as more tentpole shows choose to premiere on streaming (such as The Bear on FX on Hulu, The Acolyte on Disney+, The Boys on Prime, and Bridgerton on Netflix).

|

|

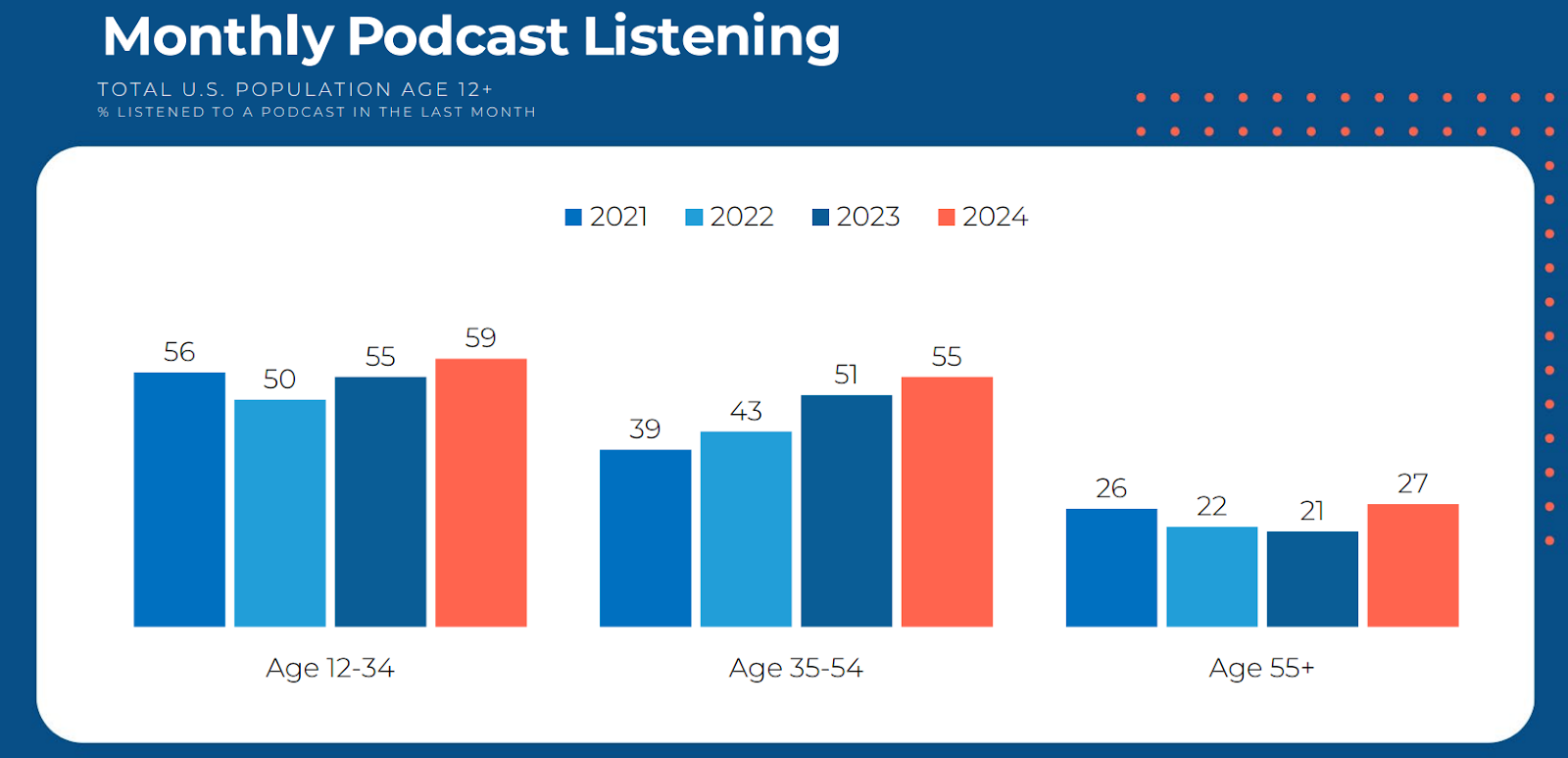

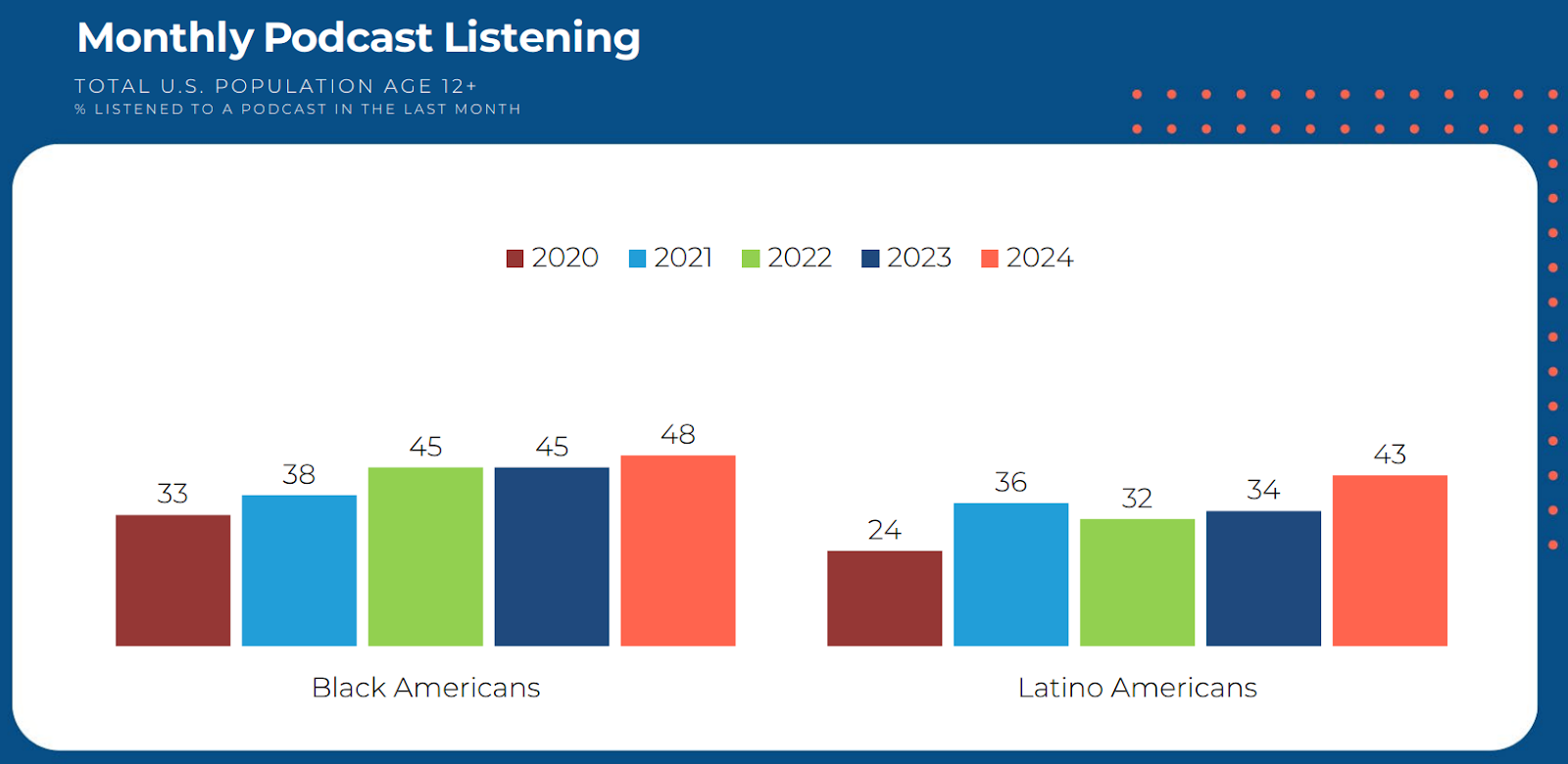

1. Edison Research is out with a new report on the state of podcast consumption in the US, and the data shows just how rapidly the medium has grown. 47 million Americans have listened to podcasts in the last month, a net rise of 5M YoY and nearly a 50% increase since 2019. Just as dramatically, US audiences have seen their share of time spent with audio sources increase five-fold in the last decade, with 20% of that time now spent with podcasts. These increases are seen across age groups and demographics (though audiences do continue to skew younger & white).

|

|

|

The growth of podcasts should not be too much of a surprise to our readership, as we’ve often called out the emerging behemoth (just last month, we highlighted how Spotify is already prioritizing video podcast inventory to push its audio advantage further). These trends emphasize the collapse of the silos separating traditional mediums. Audiences are crossing platforms to engage more holistically with the content they care about. Recent reporting shows that nearly two-thirds of sports fans listen to sports content (with 42% of Gen Z fans using podcasts to do so) while half of online Americans have listened to a TV-related podcast. Advertisers need to consider this cross-medium behavior when planning their campaigns, as it creates a golden opportunity to reach audiences multiple times, in multiple formats, with messages that work in tandem to boost awareness, consideration, and – ultimately – conversion. | Edison Research

|

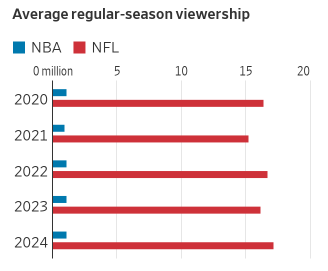

2. Inflation may be cooling on the whole, but prices for sports media are only going up. A few weeks ago, we called out that the NBA was exploring new partners to broadcast its regular season and playoff content. Now, the league is nearing agreement with NBC, ESPN, and Amazon on an 11-year media package valued at a staggering $76 billion. The agreement includes roughly 100 annual games for NBC, with half slated to air exclusively on Peacock. Amazon would take a slate of games including the in-season tournament and the playoff’s “play-in” round, while ESPN would maintain a package including the NBA Finals. This massive agreement comes just three years after the NFL agreed to a media rights package worth $110B; given the NBA’s smaller scale compared to the NFL, the $76B price tag shows how much more valuable live sports broadcasting has become over the past few years.

|

|

At the same time, the NFL could be facing a dramatic landscape shift of its own, albeit one they would be much less excited about. An antitrust class action lawsuit is going to trial in Los Angeles this month, alleging that the NFL’s “Sunday Ticket” offering (formerly sold through DirecTV, now through YouTube) is anticompetitive, threatening the league with a potential $21B payment for damages.

|

|

It’s unclear at this stage whether the suit will be successful (or if the league will choose to settle), but the lesson is obvious – the ways viewers have consumed sports media over the past decade are changing rapidly and are likely to continue to shift. Advertisers should pay close attention to these developments; as live sports remain one of the last, best ways to access large audiences in a single moment, every new way to invest represents an opportunity for challenger and incumbent advertisers alike. | WSJ, WSJ, YouTube

|

|

|

|

Together, these developments show how fraught the traditional media landscape has become. As viewership trends away from traditional linear TV and towards streaming (where audiences are themselves consolidating to just a few apps), publishers are challenged to grow their offerings in an ever more competitive landscape or be left behind to become another piece of someone else’s portfolio. These halting discussions show the value at stake for each side, and we should expect even fiercer negotiations in the future, for these companies and for their competitors. | Deadline, Deadline, Disney TV Animation News

– Harry Browne, VP Innovation

|

|

|

1. It was announced this week that BeReal is being acquired by French mobile app and games publisher Voodoo. BeReal, founded in 2019, took the US by storm in 2022 as Gen-Z users flocked to the platform to engage with their friends in a more authentic way than other Social platforms.

The upstart was founded on the idea of peeling back the layers of social media to create a community that fosters a safe space for users to be their authentic selves, and celebrate the spontaneous moments with their close connections. Early publications of the app referred to BeReal as the “anti-Instagram,” citing the filterless content as the real beauty in the lives we live.

|

|

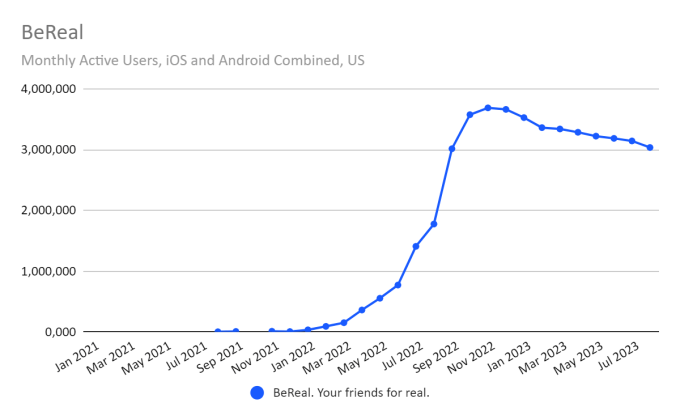

While BeReal was able to soar to 70 million daily active users worldwide, their active user count has hovered around 25 million worldwide since mid last year (~3M in US). In March, the company was considering raising Series C funding , so it’s not surprising that they were acquired.

|

|

The big news in the acquisition is the likelihood that ads will be coming to BeReal on the horizon. The BeReal press page still explicitly states that they don’t have ads and don’t have plans to prioritize brands, but it sounds like that will be changing in the very near future!

Voodoo, a company known for its high-frequency YouTube advertising, has a history of driving significant growth for mobile apps, so this could be the start of a new chapter for BeReal. While there isn’t a publicly available measurement framework, Voodoo is moving quickly to test ads on the platform. | Tech Crunch, BeReal, AdExchanger, Social Media Today, Cyber News

– Jack Johnston, , Senior Director Innovation

|

|

|

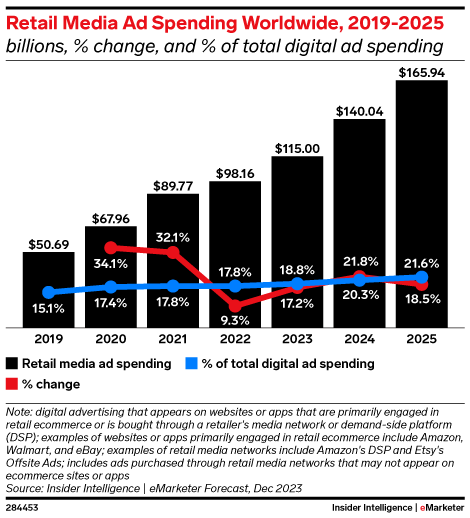

1. The growing retail media universe added another network last week as United Airlines announced the launch of its own media network, Kinective Media. This step places United among a growing number of companies, such as Chase, PayPal, Uber and Marriott, who are leveraging their first-party data to build advertising solutions.

|

|

With the move, advertisers can now connect with passengers through personalized ads across United’s platforms, including 100,000 seatback entertainment systems and their mobile app, which is the most downloaded airline app in the world. When personalized ads are shown, they are based on information travelers shared with the airline such as the city they live in, destinations they travel to and class of seat. United does note that advertisers cannot access any personally identifiable information of their travelers, and targetable audience segments are aggregated and anonymized based on customer insights from opted-in users. As expected, the Transportation Department is currently reviewing the privacy practices of United and other airlines regarding their approach to targeted advertising and the monetization of passenger data. Despite the review, advertisers can still access all of Kinective Media’s features and offerings.

Given the growth of the retail media industry, we aren’t expecting to see a slowdown of first-party data-rich companies developing their own advertising solutions. eMarketer expects retail media will account for 21.6% of total digital advertising spend next year—up from 15.1% in 2019.

|

|

These solutions are also creating novel advertising opportunities, allowing brands to connect with consumers who are most likely to turn into customers. For example, by leveraging United’s audience segments, a brand can target first-class travelers who regularly fly from New York to Miami and show them an ad for an event in Miami.

While these new networks offer unique and compelling inventory opportunities, the power lies in the ability to access a rich set of customer data. Specifically, the United offering is a good test opportunity for advertisers looking to connect with consumers based on travel insights. However, advertisers looking to leverage more expansive data sets should lean more into the new Chase media network or Paypal’s upcoming media network. As the marketplace continues to expand, advertisers should lean into these opportunities as they become available to connect with highly relevant audiences. | WSJ, United, emarketer, eMarketer, MarketingDive

– Brian Binder, Senior Director Innovation

|

|

|

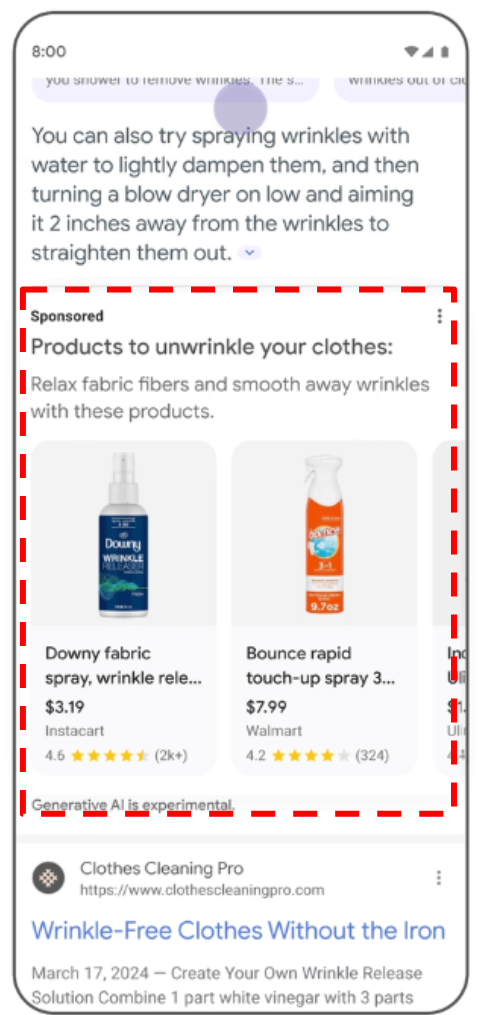

1. AI Overviews have been a hot topic since Google announced this new results page format is being rolled out nationwide in the US. Formally known as the Search Generative Experience (“SGE”), earlier versions of Google’s AI Overviews were tested by opted-in users for several months. As Google boldly rolled out AI Overviews more widely (an atypical move for Google, given their focus on iterative changes and data-driven testing), they also announced that “soon” Google will start testing Search and Shopping ads in AI Overviews for users in the US, but gave no clear timelines or additional details about the scope of these changes.

|

|

Since these announcements, advertisers have been wondering, “What does this mean for me?” The answer? It’s not 100% clear. When pressed for details, Google’s team hasn’t been able to give much direct guidance.

The only comms Google has explicitly shared so far suggest that brands who are already using Google’s AI-powered advertising solutions will be best equipped to drive performance on AI Overview SERPs:

“Your ads from existing AI-powered Search and Performance Max campaigns will have the opportunity to appear within the AI Overview in a section clearly labeled as ‘Sponsored’ when they’re relevant to both the query and the information in the AI Overview. By showing ads directly in AI Overviews, consumers will have more opportunities to discover relevant products and services, and take action as they learn about things your business can help with.”

In any case, we expect that advertisers who are appropriately leveraging PMAX, Broad Match keywords and value based bid strategies can thrive in AI Overview placements. Most of the queries that trigger AI Overviews appear to be more long tail and “discovery” based (ex: “how to keep bananas fresh longer”, or “how do I get wrinkles out of clothing?”). Broad Match coupled with smart bidding is a perfect targeting option to ensure your ads are eligible to appear for these discovery-based queries when the bidder anticipates your goals / efficiency targets will be achieved.

Advertisers should continue leaning into these AI-powered advertising solutions with strategic human oversight and inputs. We don’t expect AI to get everything right, but we do expect that AI-powered solutions and formats will continue to be at the forefront of Search’s evolution.

For now, we’re actively in “watch and see” mode given the nascency of this new SERP format and limited insight into measurement. At least one report from early June indicated that AI Overviews visibility was dropping, now showing for only ~15% of queries (note: this was SEO-related data, not specific to paid search advertising). This is likely in part an intentional reduction in visibility on Google’s part in response to odd results that were being surfaced. Google could be trying to mitigate risk of incorrect AI-generated answers as they continue fine tuning the technology. We wouldn’t be surprised if this ~15% starts to climb back upward as the relevance and accuracy improves over time. | Google’s The Keyword Blog, Google Ads Help, Google Search Help, Search Engine Land

– Michelle Merklin, VP of Paid Search Growth & Innovation

|

|

|

1. It has been a rollercoaster of a week for Oracle shareholders. First, Oracle reported missing their Q4 earnings by 1.91% (-$278.65M), immediately followed by the announcement of deals with both Google & OpenAI that served as the catalyst for a 15%+ share price rally. Of note, the earnings miss was almost exactly in line with the downturn noted in their advertising business ($300M) in Q4. Despite having made several high-profile acquisitions and invested billions looking to crack the nut on advertising, it would appear that Larry & Co are calling it a day on advertising as it was announced that Oracle is exiting the advertising space. | CNBC, AdWeek

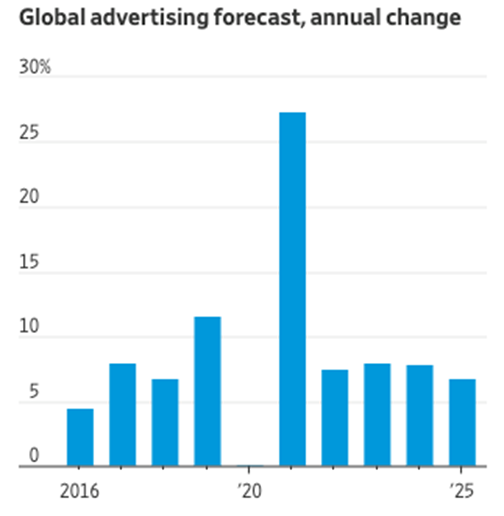

2. Speaking of oracles, WPP-owned GroupM shared their updated forecast for 2024 advertising growth, revising up to the tune of nearly $990 billion globally this year, suggesting a 7.8% YoY growth in advertising spend. Critically, this revision excludes US political spending which, as with all prior presidential elections, is slated to set a new record for advertising investment at ~$12 billion according to eMarketer’s December 2023 forecast. | WSJ, eMarketer

– Simon Poulton, EVP Innovation

|

|

|

|

|

|

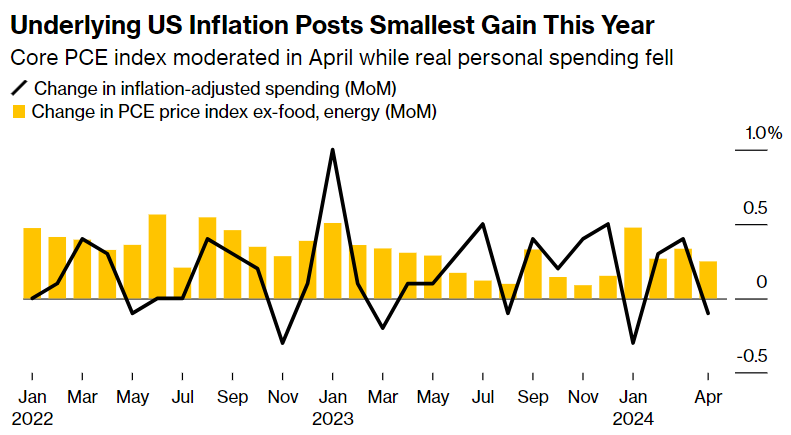

1. For the past three years, the US’s principal macroeconomic concern has been inflation – a huge increase in the money supply in early 2020 preceded inflation the country hadn’t seen in over four decades. There was a great deal of optimism late last year that we’d had an ‘immaculate disinflation’ – bringing inflation back down without triggering a rise in unemployment – and that the Fed would soon begin a concerted process of reducing interest rates; this narrative has not panned out, with no rate reductions to date and inflation figures remaining stubbornly elevated.

With newly published April data, there is renewed optimism that inflation is trending down, and that the Fed will be able to lower interest rates this year. The personal consumption expenditure (PCE) index, which is the Fed’s favored gauge of inflation, increased 0.2% on a MoM basis, the slowest rate of the year thus far. (for reference: MoM inflation of 0.165% is consistent with the Fed’s target of 2% annualized inflation) On a YoY basis, the PCE index increased at a rate of 2.7%.

|

|

Inflation-adjusted consumer spending fell 0.1%, dragged down by a decrease in outlays for goods and softer services spending. Wage growth was 0.2%, the smallest gain in five months; with nominal wage growth generally understood to be highly correlated with price inflation, this kind of moderation is broadly welcome by inflation watchers. | Bloomberg, NYT

Update: Figures have just been released for the consumer price index – CPI, which is a different measure of the price level than PCE – and they show core prices rose 0.2% from April, the smallest MoM rise since 2021. | WSJ

|

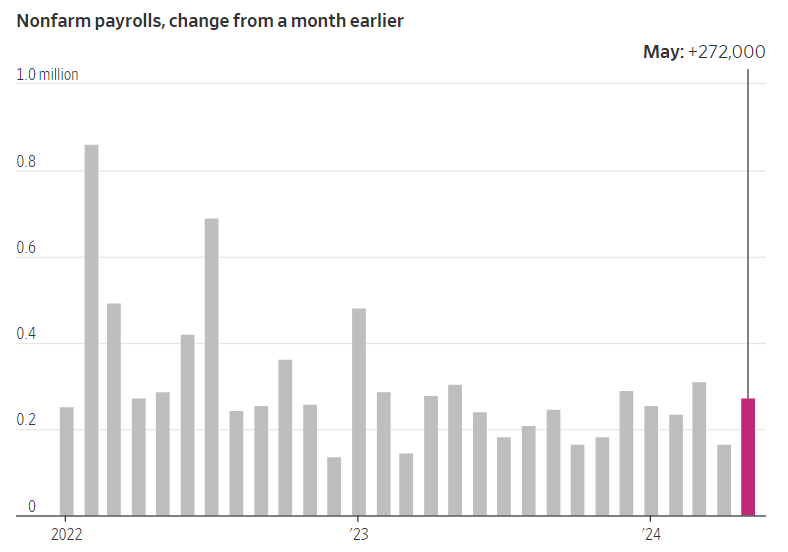

2. We told you last week about dropping unemployment claims signaling continuing strength in the labor market following some wobbly indicators. The payroll figures for May are now in, and they show that U.S. businesses added 272k jobs in May, far exceeding April’s figure and surpassing the expectations of most economists.

|

|

Despite the robust May figures, unemployment ticked up from 3.9% to 4.0%. That figure remains extremely low by historical standards; indeed, the unemployment rate has been at or below 4% for 30 months, something most working-age Americans never have experienced.

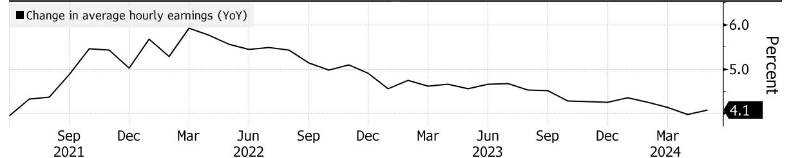

Average wage growth for May was 0.4% MoM and 4.1% YoY, with the monthly figure ticking up from April (see story above).

|

|

Most analysts expect these data will preclude any rate reductions from the Fed in the very near term. | WSJ, Bloomberg

3. And finally, we told you back in May that US household debt had reached a new record, with $17.7 trillion outstanding (for reference, US GDP is about $25.5 trillion). As any major borrow could tell you (looking in your direction, Congress …), debt becomes significantly more onerous when interest rates rise, as has been the case in the US over the past few years.

Important context for rising debt loads is the ability to service debt – and happily, US household net worth reached a new record of $160.8 trillion in Q1, a rise of 3.3% from the prior quarter. Most of the gains were driven by the exceptional performance of the stock market, which added about $3.8 trillion to household balance sheets; increases in real estate value added another $900 billion. Perhaps unsurprisingly, consumers and businesses took the opportunity to increase their borrowing during the quarter, despite the elevated interest rate environment. | Bloomberg

– Sean Odlum, CPO

|

That will do it for this week – as ever, if you have questions about how any of these items impact your own campaign please don’t hesitate to reach out to your Tinuiti team.

--

If you wish to unsubscribe from this newsletter, click here. Or if you prefer to unsubscribe from all emails sent by Tinuiti, click here.

|

|

|

|

|

|

|

|